TERMS AND CONDITIONS OF SERVICE

- THESE TERMS

- What these terms cover. These are the terms and conditions on which we supply products to you, whether these are goods, services or digital content.

1.2 Why you should read them. This document sets out the basis on which we will conduct business with you and on your behalf. It is an important document, and we would ask you to read it carefully and if you are unsure of any of its terms please ask. These terms tell you who we are, how we will provide products to you, how you and we may change or end the contract, what to do if there is a problem and other important information. If you think that there is a mistake in these terms, please contact us to

discuss.

- INFORMATION ABOUT US AND HOW TO CONTACT US

2.1 Who we are. BOCC Finance Limited is a firm registered in England & Wales under registration – 13307925 Registered Office – 19 & 20 Neptune Court, Vanguard Way, Cardiff, CF24 5PJ (“BOCC Finance Limited”)

2.2 BOCC Finance Limited is an appointed representative of Specialist Finance Centre, who is authorised and regulated by the Financial Conduct Authority (FCA) under the firm reference number of 918488 although we also broker loans that fall outside of the scope of regulation. We will make you aware of the regulatory status of your loan type during the initial stages of our service.

2.3 The FCA regulates financial services in the UK and you can check our authorisation and permitted activities on the Financial Services Register by visiting the FCA’s website https://register.fca.org.uk or by contacting the FCA on 0800 111 6768. Our FCA firm reference number is 918488

2.4 How to contact us. Phone: 02922 744285 – Email: info@boccfinance.co.uk

2.5 If you have a complaint. A summary of our internal complaints handling procedures are available upon request, and if you cannot settle your complaint with us using the contact details in clause 2.4, you might be entitled to refer it to the financial ombudsman services at http://www.financial-ombudsman.org.uk or by contacting them on 0800 023 4 567.

2.6 Compensation Scheme. We are covered by the FSCS. You may be entitled to compensation from the scheme if we cannot meet our obligations. This depends on the type of business and the circumstances of the claim. For claims against companies declared in default from 1st April 2019. Mortgage advising and arranging is covered for 100% of the first £85,000 so the maximum compensation is £85,000 per person per firm. Further information about compensation scheme arrangements is available from the FSCS. Visit www.fscs.org.uk or 0800 678 1100.

2.7 How we may contact you. If we have to contact you we will do so by telephone or by writing to you at the email address or postal address you provided to us.

2.8 “Writing” includes emails. When we use the words “writing” or “written” in these terms, this includes emails unless otherwise expressly stated in these terms.

- OUR CONTRACT WITH YOU

3.1 How we will accept your request to process your application. Our acceptance of your request to process your application will take place when we email you to accept it or provide the confirmation through our One Mortgage Service (OMS) software, at which point a contract will come into existence between you and us.

3.2 We will accept your instruction to us over the telephone or through our “One Mortgage Service” OMS software.

3.3 We will not be in breach of this agreement with you and shall not incur any liability to you if there is any failure to perform our duties due to circumstances outside our control.

- OUR ETHICAL POLICY

4.1 We are committed to providing the highest standard of advice and service possible. The interest of our customers is paramount to us and to achieve this we have designed our systems and procedures to place you at the heart of our business.

4.2 In doing so, we will:

4.2.1 be open, honest and transparent in the way we deal with you;

4.2.2 not place our interests above yours;

4.2.3 communicate clearly, promptly and without jargon;

4.2.4 seek your views and perception of our dealings with you to ensure it meets your expectations or to identify any improvements required.

- OUR PRODUCTS AND SERVICES

5.1 We offer regulated and unregulated first and second charge mortgage contracts, buy to let mortgage contracts, bridging loans and development financing of either business or personal use.

5.2 We are a broker using a representative panel of lenders who specialise in these products. A copy of our lender panel is available upon request.

5.3 For our advised proposition, we will consider all lenders we have access to before recommending a suitable product following an assessment of your personal needs and circumstances. This will include a detailed assessment of affordability, and we will also require evidence of your income as part of the application process.

5.4 For our unregulated packaging only proposition, we act on a non-advised basis, providing the relevant information for you to make an informed decision as to whether or not the loan is suitable. We will of course provide as much information as we can to aid this decision.

- 5.5 In cases of further borrowing, you should be aware that there may also be other finance options available to you such as a further advance with your first charge lender, a new first charge mortgage, a second charge mortgage or an unsecured loan. We do not advise on unsecured loan options.

5.6 The estimated completion date for the services is as told to you during the order process.

5.7 If you are purchasing a mortgage, your mortgage offer will be set out in your mortgage agreement and is based on you providing accurate and complete information. Changes to any of the information provided including the valuation report, could alter the mortgage offered. You will also receive an ESIS that show the key features of the mortgage being offered to you, including the term, the interest rate, repayments and the total amount payable as well as details of the lender. The ESIS is an important document and you need to read its contents carefully.

YOUR RIGHTS TO MAKE CHANGES

6.1 If you wish to make a change to the product you have selected, please contact us. You cannot cancel a mortgage once the process has completed, however you can cancel the application at any point before completing and you will have sufficient time to consider your options. Subject to clause 6.2, should you wish to cancel your application there will be no further charges applicable.

6.2 Should you decide not to proceed after we have incurred processing costs, you may be liable to pay some or all of these costs. If you have not chosen to pay our fee upfront in accordance with clause 7.2.2 our reasonable costs will be deducted from the broker fee.

- FEES AND PAYMENTS

7.1 We will charge a brokers fee for processing your application. This will be discussed and agreed with you before the application pack is issued to you and will be contained in the European standardised information sheet (“ESIS”) or in any mortgage offer documentation which will be sent to you before you make a decision whether to proceed.

7.2 These fees may be paid by either:

7.2.1 The fee is added to your product advance and is paid to us by the lender upon completion; or

7.2.2 Pay the fee upfront.

7.3 If you have chosen to add the broker fee to your mortgage or loan product, it will be incorporated within the monthly repayment and interest will be charged on it.

7.4 If you have chosen to pay the fee upfront, you will need to pay this to us prior to completion.

7.6 Our broker fee will vary depending on the loan amount being applied for. We will discuss our fee scale with you before you make an application.

An example of our fees are as follows;

First Charge Mortgage

An advice fee of £495.00 will be payable upfront upon agreement to these Terms and Conditions of Service.

A broker fee, minimum of £1,995 or 1% of the mortgage loan amount will be payable for arranging and submitting your mortgage application. For example, if your mortgage was £300,000 our fee will be £3,000.

Second Charge Mortgage

An advice fee of £195.00 will be payable upfront upon agreement to these Terms and Conditions of Service.

We will charge a broker fee of up to 10% of the mortgage loan for arranging and submitting your mortgage application. For example, if your second charge mortgage was £10,000 our maximum fee would be up to £1000. Our fee is capped at a maximum of £4995. If your 2nd charge mortgage was £100,000 our maximum fee could be £4995.

7.7 We will receive and retain a commission from the lender when your product completes. This amount will be confirmed by the lender in their disclosure document. We do not offset any of the commission received from the lender against the broker fee. Should you wish you can request to view the commission rates from each of the lenders we have considered at the time that we make our recommendation to you. Any commission is paid directly to us by the lender and does not alter the terms described in your mortgage or loan product agreement.

7.8 Where you were introduced to us by a third party, we may pay them commission, but this will not cost you anything extra.

7.9 In commitment to ensuring our customers are receiving fair value, you’ll only pay one broker fee for your mortgage application through BOCC Finance Limited. If you have paid your introducing broker a separate fee for this particular mortgage, please let us know.

7.10 Please note, at our discretion our fee(s) will still be charged should the lender reject your mortgage application due to you not disclosing any material information about your personal situation. It should also be noted we do not provide a refund should you decide not to proceed with the mortgage after you have made an application to the lender.

- MISSING PAYMENTS

8.1 It is important that you maintain your repayments on time and in full. The consequences of missing payments or underpaying will be explained in the mortgage or loan agreement, but can include default charges, and in extreme circumstances, repossession of your property if your product is a mortgage. This can also affect your credit rating and your ability to obtain credit in the future.

You may be using your mortgage to pay off other debts, including some unsecured credit. The repayments on your new loan may be lower than the combined monthly repayments on your other debts, but over a longer term you could end up paying more interest overall. Think carefully before securing a loan against your home. It is important to note the difference between secured and unsecured credit; your home may be repossessed if you do not keep up repayments on a secured loan.

8.2 We do not give advice on or arrange insurance products. You will still have to pay your loan if you lose your job or if illness prevents you working. You should consider the affordability of your loan if your income falls and protecting yourself against unforeseen circumstances.

8.3 Please be aware that your home may be repossessed if you do not keep up repayments on a mortgage.

HOW WE MAY USE YOUR PERSONAL INFORMATION

9.1 How we may use your personal information. We will only use your personal information as set out in our Privacy Policy in this document.

9.2 Client Verification. We are required to verify your identity, to obtain information as to the purpose and the nature of the business which we are instructed to carry out on your behalf, and to ensure that the information we hold is up to date. For this purpose we may use an electronic identity verification systems and we may conduct these checks from time to time throughout our relationship.

- OTHER IMPORTANT TERMS

10.1 We may transfer this agreement to someone else. We may transfer our rights and obligations under these terms to another organisation within our group.

10.2 You cannot transfer this agreement to someone else. This agreement is personal to you and the advice we provide is personal to you only.

10.3 Nobody else has any rights under this contract. This contract is between you and us. No other person shall have any rights to enforce any of its terms. Neither of us will need to get the agreement of any other person in order to end the contract or make any changes to these terms.

10.4 If a court finds part of this contract illegal, the rest will continue in force. Each of the paragraphs of these terms operates separately. If any court or relevant authority decides that any of them are unlawful, the remaining paragraphs will remain in full force and effect.

10.5 Which laws apply to this contract and where you may bring legal proceedings. These terms are governed by English law and you can bring legal proceedings in respect of the products in the English courts. If you live in Scotland you can bring legal proceedings in respect of the products in either the Scottish or the English courts. If you live in Northern Ireland you can bring legal proceedings in respect of the products in either the Northern Irish or the English courts.

This is our standard agreement upon which we intend to rely. For your own benefit and protection, you should read the terms carefully. If you do not understand any of these, please ask for further information.

Privacy Notice

Why should you read this document?

During the course of dealing with us, we will ask you to provide us with detailed personal information relating to your existing circumstances, your financial situation and, in some cases, your health and family health history (Your Personal Data). This document is important as it allows us to explain to you what we will need to do with Your Personal Data, and the various rights you have in relation to Your Personal Data.

The Data Protection Officer for BOCC Finance Limited “Our Company” is Rebecca Bailey. We are registered with the Information Commissioners Office (ZB978974)

What do we mean by “Your Personal Data”?

Your Personal Data means any information that describes or relates to your personal circumstances. Your Personal Data may identify you directly, for example your name, address, date of birth, national insurance number. Your Personal Data may also identify you indirectly, for example, your employment situation, your physical and mental health history, or any other information that could be associated with your cultural or social identity.

In the context of providing you with assistance in relation to your Mortgage requirements Your Personal Data may include:

- Title, name, date of birth, gender, nationality, civil/marital status, contact details, addresses and documents that are necessary to verify your identity

- Employment and remuneration information, (including salary/bonus schemes/overtime/sick pay/other benefits), employment history

- Bank account details, tax information, loans and credit commitments, personal credit history, sources of income and expenditure, family circumstances and details of dependents

- Health status and history, details of treatment and prognosis, medical reports (further details are provided below specifically with regard to the processing we may undertake in relation to this type of information)

- Any pre-existing mortgage and finance products and the terms and conditions relating to these Special Category Data In the course of your interactions with BOCC Finance Limited you may share information that is classified as ‘Special Category Data’. This could include data about:

- Race

- Ethnic origin

- Politics

- Religion

- Trade union membership

- Genetics

- Biometrics

- Health

- Sex life

- Sexual orientation

Where you do share information relating to any of these categories e.g., when you may share information about your health or a characteristic of vulnerability BOCC Finance Limited will always seek explicit consent from you to store and process such information.

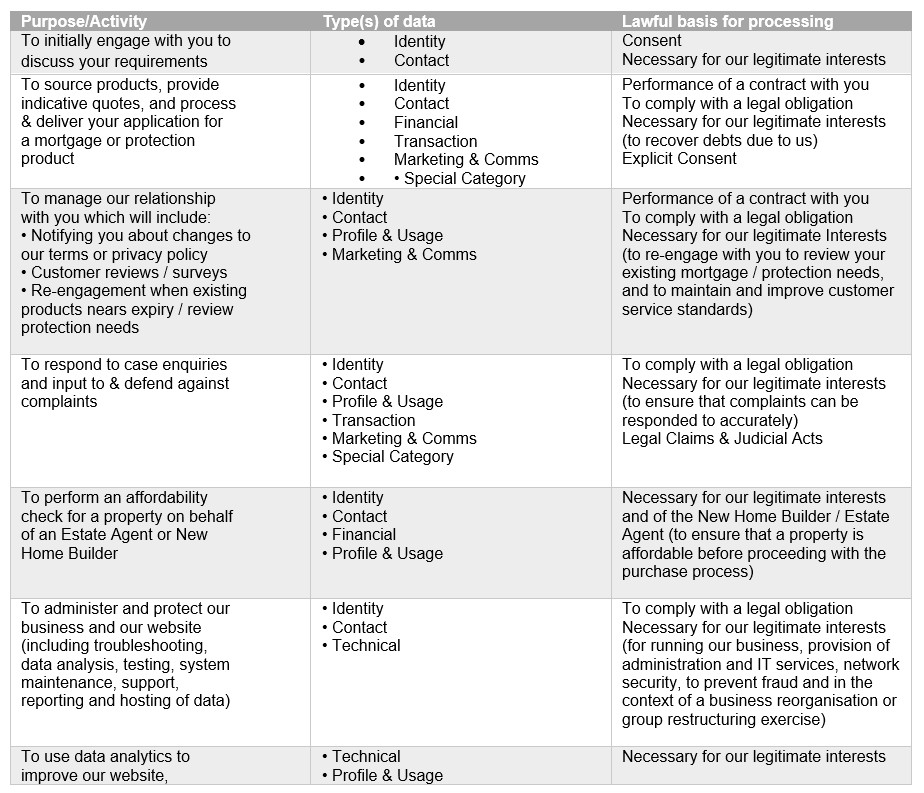

How will we use your data?

Our Company collects your data so that we can:

- Process your application and manage your request.

- Email you with special offers on other products and services we think you might like.

- To monitor the performance of our products and services to ensure consumer outcomes are being achieved

Lawful Basis for Processing Data

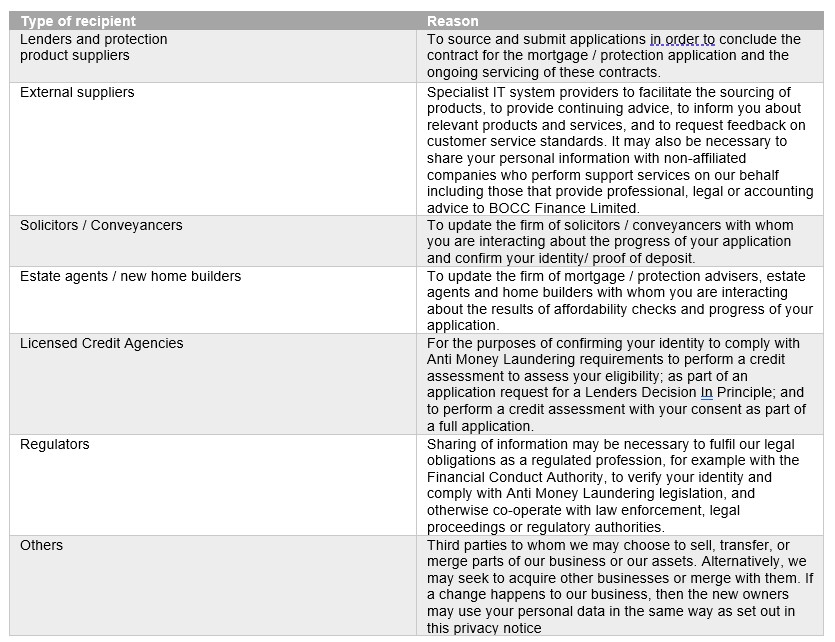

If you agree, Our Company will share your data with our partner companies so that they may offer you their products and services

When Our Company processes your data, it may send your data to, and also use the resulting information from, credit reference agencies to prevent fraudulent purchases.

How do we store your data?

We do not envisage that the performance by us of our service will involve Your Personal Data being transferred outside of the United Kingdom.

Security and retention of Your Personal Data

Your privacy is important to us and we will keep Your Personal Data secure in accordance with our legal responsibilities. We will take reasonable steps to safeguard Your Personal Data against it being accessed unlawfully or maliciously by a third party.

We also expect you to take reasonable steps to safeguard your own privacy when transferring information to us, such as not sending confidential information over unprotected email, ensuring email attachments are password protected or encrypted and only using secure methods of postage when original documentation is being sent to us.

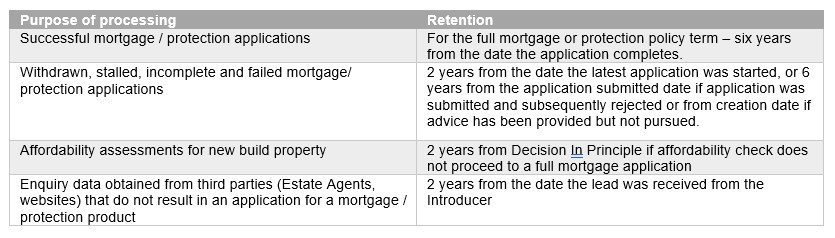

Your Personal Data will be retained by us either electronically or in paper format for a minimum of six years, or in instances whereby we have legal right to such information we will retain records indefinitely.

Marketing

BOCC Finance Limited understands that with the introduction of the Consumer Duty, it is likely the level of communications issued by our business will increase. This will be necessary to support customers to understand the products and services offered and to provide support to customer throughout the lifecycle of the relationship.

You have the right at any time to stop Our Company from contacting you for marketing purposes or giving your data to other members of the Our Company Group.

What are your data protection rights?

Our Company would like to make sure you are fully aware of all of your data protection rights. Every user is entitled to the following:

The right to access – You have the right to request Our Company for copies of your personal data. We may charge you a small fee for this service.

The right to rectification – You have the right to request that Our Company correct any information you believe is inaccurate. You also have the right to request Our Company to complete the information you believe is incomplete.

The right to erasure – You have the right to request that Our Company erase your personal data, under certain conditions.

The right to restrict processing – You have the right to request that Our Company restrict the processing of your personal data, under certain conditions.

The right to object to processing – You have the right to object to Our Company’s processing of your personal data, under certain conditions.

The right to data portability – You have the right to request that Our Company transfer the data that we have collected to another organisation, or directly to you, under certain conditions.

If you make a request, we have one month to respond to you. If you would like to exercise any of these

rights, please contact us at:

Rebecca Bailey – BOCC Finance Ltd, 19 & 20 Neptune Court, Vanguard Way, Cardiff, CF24 5PJ Tel: 02922 744 285

Email – becky@boccfinance.co.uk

How to make contact with our Firm in relation to the use of Your Personal Data

If you have any questions or comments about this document, or wish to make contact in order to exercise any of your rights set out within it please contact:

Rebecca Bailey – BOCC Finance Limited, 19 & 20 Neptune Court, Vanguard Way, Cardiff, CF24 5PJ

Tel: 02922 744 285

Email – becky@boccfinance.co.uk

If we feel we have a legal right not to deal with your request, or to action, it in different way to how you have requested, we will inform you of this at the time.

You should also make contact with us as soon as possible on you becoming aware of any unauthorised disclosure of Your Personal Data, so that we may investigate and fulfil our own regulatory obligations. If you have any concerns or complaints as to how we have handled Your Personal Data you may lodge a complaint with the UK’s data protection regulator, the ICO, who can be contacted through their website at https://ico.org.uk/global/contact-us/ or by writing to Information Commissioner’s Office, Wycliffe House, Water Lane, Wilmslow, Cheshire, SK9 5AF.

Changes to our privacy policy

Our Company keeps its privacy policy under regular review and places any updates on this web page.

This privacy policy was last updated on 20 November 2025.